- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

getty

Since March, central banks around the world have flooded the globe with newly printed money. As usual, we went “big” here in ‘Merica, with $3 trillion and counting flooding into everything from tech stocks to gold to bonds.

Who exactly is buying a US Treasury yielding 0.7%? Perhaps rich guys and gals with $10 million or more in the bank. Even then, these bonds are paying just $70,000 annually on that ten-mil! Which means a wealthy bond bull must tap into some capital or kiss that country club membership goodbye.

The Federal Reserve, of course, a big buyer. It’s distorting the market and keeping interest rates low, to the benefit of corporations but the chagrin of retirees. In fact, just last week Powell made the policy official. He promised to do his best to avoid raising rates ever!

So, we must look elsewhere for income. Today, we can hop a plane down to Peru and purchase some government bonds paying 8.75%. The country was a financial train wreck in the 1970s and 80s, so investors demand high coupons. However, the country now has one of the strongest balance sheets in Latin America, with a government debt-to-GDP ratio of just 27%.

(By comparison, we were running a hot 107% here in the US before all of this stimulus and money printing. If we didn’t own the printing presses for the world’s reserve currency, investors might demand higher coupons from us, too!)

Sounds complicated, but it’s much easier to buy these bonds than to hike Machu Picchu. We can get them at a discount from the convenience of our own computers by typing in the ticker for a discounted closed-end fund (CEF).

One of the great advantages of CEF investing is our ability to demand these discounts. (In fact, in our next section, I’m going to show you how we turned an 8% discount into a 76% return.) There are even academic studies backing up our strategy.

Our big edge buying these funds is our ability to pay less than face value for perfectly good assets. Matisse Capital’s Eric Boughton shared his firm’s research (conducted with the University of Oregon’s Lundquist College of Business) on CEFs at the Inside Fixed Income conference I attended (in person!) in San Diego last December.

He explained that if you’d taken the 600+ CEFs in existence since 2008 and simply bought the funds trading at discounts to their net asset values (NAVs), you’d have earned 11% per year. (This assumes you “rebalanced” monthly to sell any funds that swing to premiums and reinvest the money in newly discounted funds.)

Eleven percent per year is pretty good, especially given the lack of thought required to execute on this strategy! And, of course we can further improve on it by cherry-picking our timing and funds.

“But Brett,” subscribers often ask, “Must we demand the discount? Or is it OK to pay a premium for a top notch CEF?”

We’re all adults here, and you can do whatever you’d like. But if you want the odds in your favor, you’ll demand the discount. Here’s why.

Let’s consider my favorite preferred stock fund, Flaherty & Crumrine Dynamic Preferred & Income (DFP). It’s a mouthful to say, on par with the fund’s hefty 7.4% dividend. And this payout has been on the move in 2020, heading higher not once, but twice.

This monthly payer has already hiked twice since January for a cumulative dividend increase of 15.4%:

“Preferred” Dividend Payments from DFP (Year-To-Date)

Contrarian Outlook

Problem is, income investors have finally identified this gravy train and bid its price to a 4% premium of its net asset value (NAV). This means they are paying $1.04 for just $1 in assets.

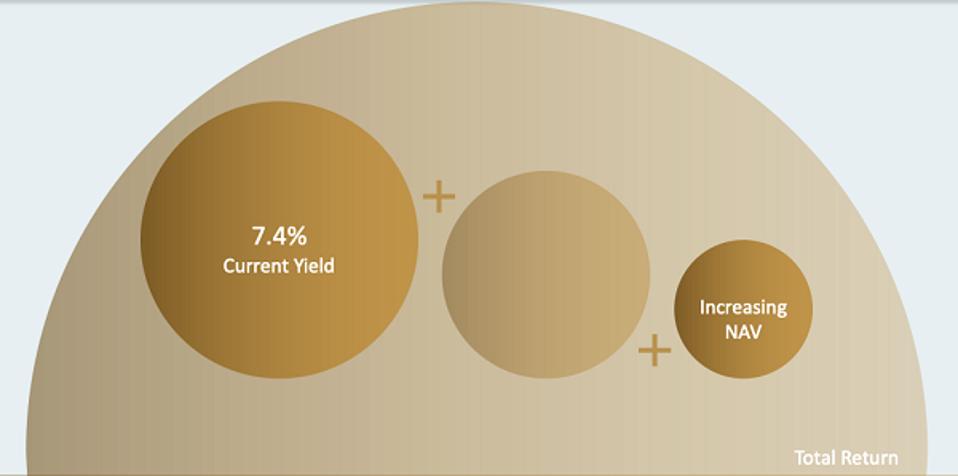

This can work out if DFP maintains its premium, or if investors decide they “must have” the fund and pay an even-more-irrational $1.10 for $1 in assets (a 10% premium). But the wind isn’t perfectly at our backs, with “only” two ways to make money:

- DFP’s current 7.4% yield, and

- The hope that NAV will increase.

(Please note, I am not including the longshot wish that DFP’s premium will also increase. It is possible, but not likely! A rising NAV is a higher probability, but the dividend is the most bankable.)

7.4% Yield and 2 Ways to Win

Contrarian Outlook

Is there something missing in the middle of the formula? You bet, it is the potential for the discount window to close. This is something we have enjoyed as DFP shareholders.

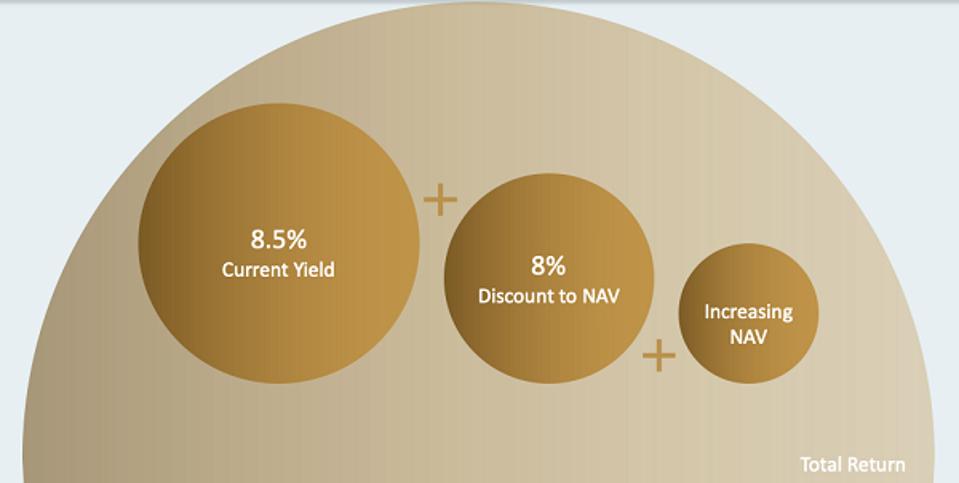

When we bought the fund way back in October 2015 for our Contrarian Income Report portfolio, shares traded at an 8% discount to their NAV. In other words, we snagged it for just $0.92 on the dollar then, versus the $1.04 that investors are paying for it right now.

Another benefit of paying less for the portfolio is that our yield gets “juiced” by our discount. It’s a subtle point, but a powerful (and profitable) one. CEFs are like stocks. When we overpay we tend to “settle” for smaller yields (or, worse, no yields at all).

CEFs are similar. The fund’s holdings yield what they yield, but what we income investors fork over for the stock directly affects the dividend we’ll consume as a result. Here’s the formula we were staring at back in the good old days of DFP trading for a discount:

8.5% Yield and 3 Ways to Win

Contrarian Outlook

If we’re being greedy about things (and why not?), we really want to buy a discount window that can close. This maximizes our potential upside and, in doing so, also provides us with a margin of safety on the downside.

Here’s what we’re looking for with a “window closing.” An 8% discount to NAV means a $20 fund (to pick a round number) would be trading for just $18.40. As the window “shuts,” the price will rise. Even if NAV is merely flat, this means we enjoy price upside in addition to our dividend payments!

How an 8% CEF Discount Precedes Price Upside

Contrarian Outlook

In the case of DFP, we were rewarded with a window closing and more, including:

- Modest NAV gains (+5%),

- Plus, the discount-to-premium flip we mentioned,

- Plus, monthly dividend payments,

- Equaled total returns of 76%.

Would we have made money had we bought DFP during one of its times trading at a premium? Sure, but we wouldn’t have banked as much. It pays to be picky in CEF-land, when there is usually some great fund trading at a discount to the value of its holdings.

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: Your Early Retirement Portfolio: 7% Dividends Every Month Forever.

Disclosure: none